Leveraging China‘s booming housing stock is one avenue that could help the country reach net zero.

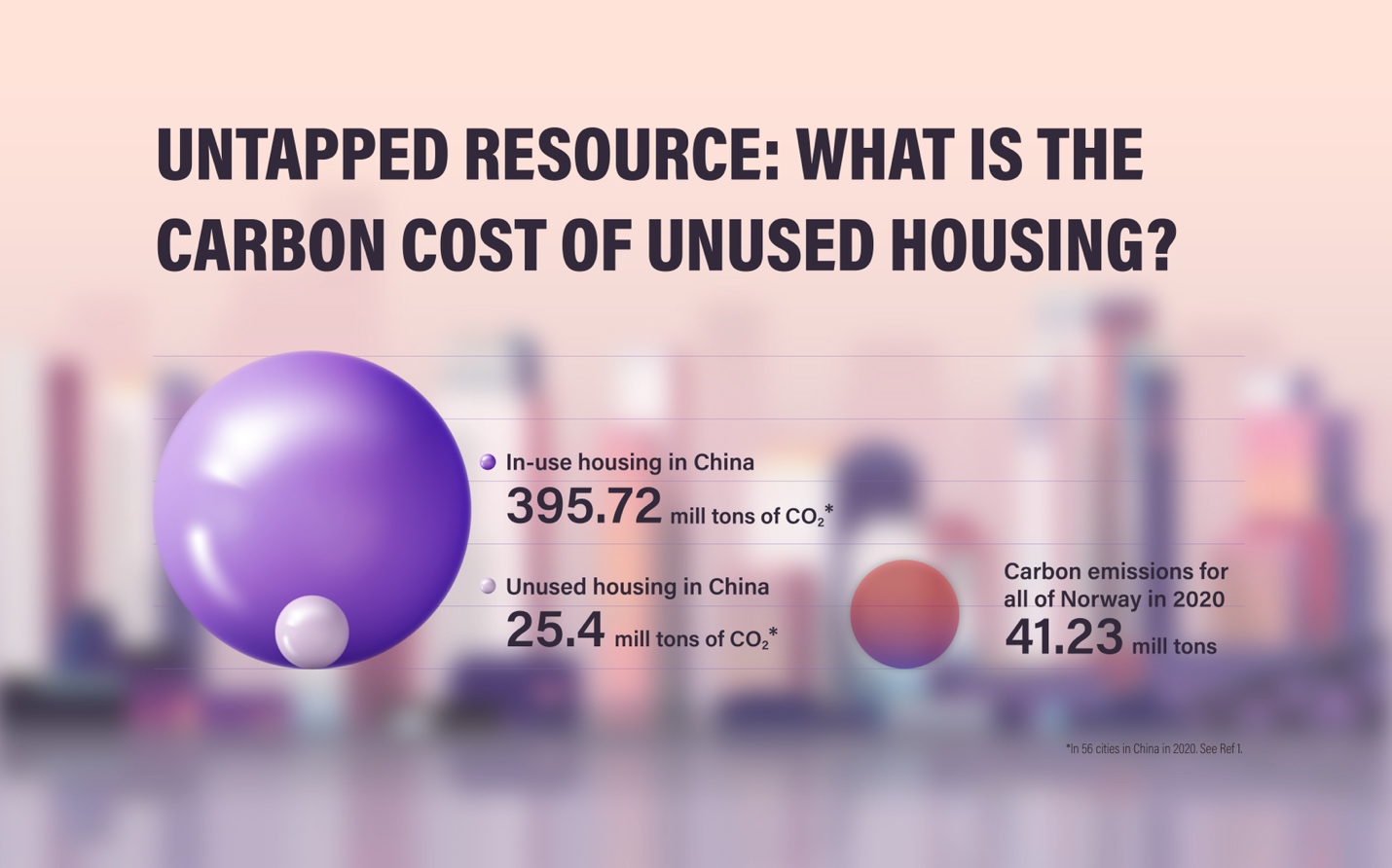

If about half of China’s vacant homes were occupied by 2030, the country’s residential carbon emissions could be reduced by roughly 9%, according to a 2025 Tsinghua analysis published in Nature Communications.1

The construction and operation of buildings account for one fifth of global greenhouse gas emissions — thanks to the steel, cement and other materials required, as well as the electricity and gas used to heat and run them.

And across the past few decades China has also experienced a record housing boom, with 11.5 billion square meters of urban housing springing up between 2001 and 2020 — half of all new housing built globally.

A 2025 analysis found that more than 10% of recently constructed Chinese homes could be filled, which would maximize their carbon efficiency.

But that rapid expansion has also resulted in a growth in underused stock, says Jing Wu, a professor in Tsinghua University’s Department of Construction Management. Some of these homes just have low occupancy, while others may be sitting empty after they were purchased for mainly investment purposes, he explains.

However, until now there were few reliable statistics on the volume or proportion of vacant housing in China or any other country.

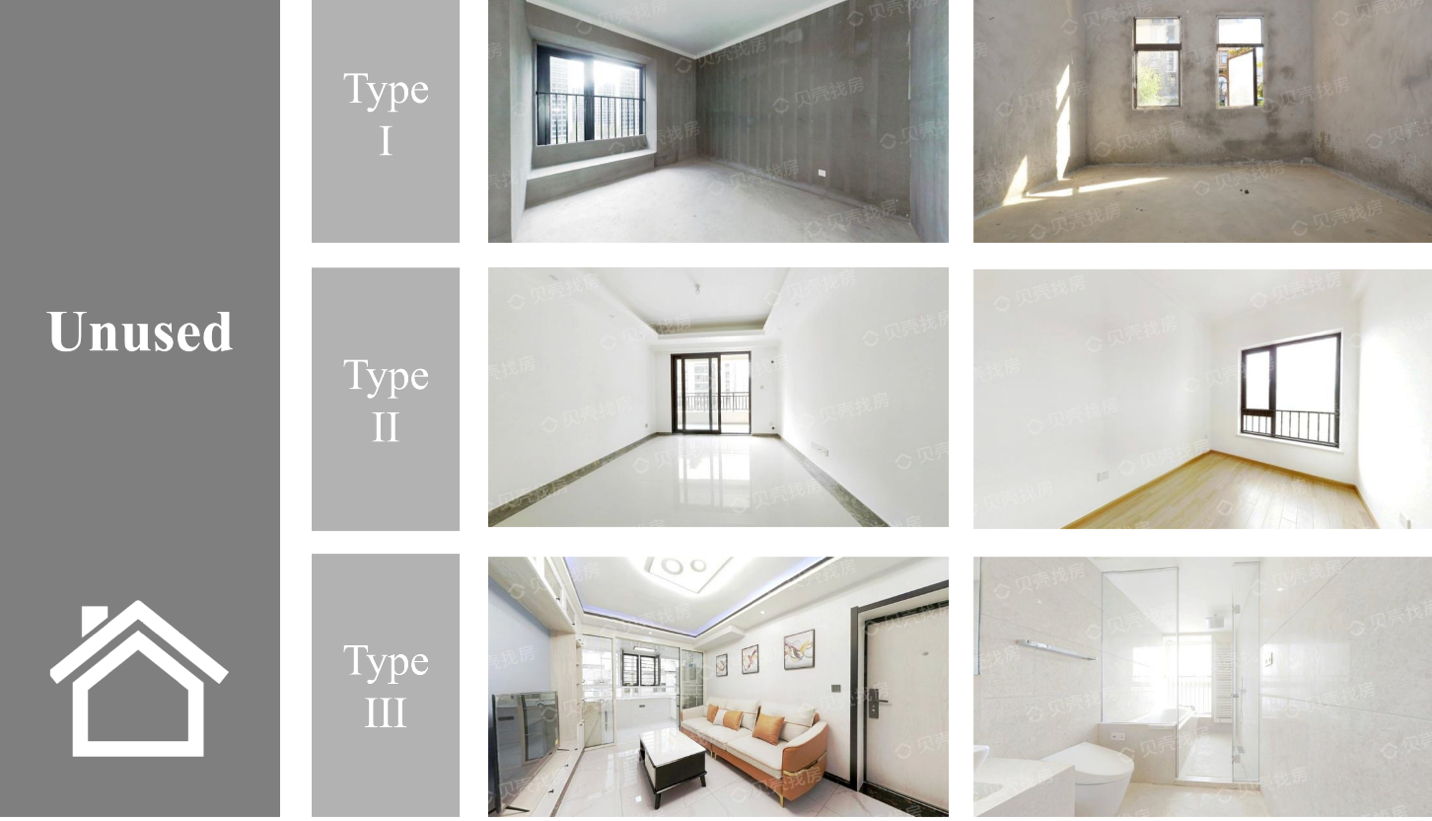

AI trained on more than six million photos from a popular housing rental and sales platform was able to discriminate between recently used and unused housing. The model learned to flag photos of three types of potentially unused housing — including homes that were undecorated (Type I), partly decorated (Type II) and pristine (Type III).

Insights from image analyzing AI

To determine the carbon footprint of China’s currently vacant homes, Wu and his team trained a deep-learning model to trawl through online listings on a leading housing platform.

This program analyzed the pictures posted, as well as text information, to identify unused units — defined as those that had been built and sold at least two years earlier, but never occupied.

In total, the model examined nearly 1.2 million listings, comprising more than 6.5 million photos, posted between October 2020 and August 2021. The housing units were located in 56 major cities, which accounted for 45% of China’s urban population in 2020.

From this, the researchers estimated the volume of unused housing for each city studied. Their analysis revealed that 17.4% of China’s urban housing stock completed between 2001 and 2018 remained unoccupied as of early 2021. The phenomenon was most pronounced in smaller, third-tier cities, the authors report.1

Professor Jing Wu works for Tsinghua University’s Department of Construction Management.

Carbon neutralization

The team then calculated the carbon emitted by these dwellings. “Even if an apartment isn’t occupied, its central heating system usually remains switched on as part of a building-wide network in colder northern cities, which means it keeps consuming energy,” explains Wu.

They found that overall, the construction and operation of this unused housing accounts for 6.9% of China’s total residential-sector carbon emissions. “This was much higher than our original expectations,” says Rongjie Zhang, a former PhD student in Wu’s lab, who initiated the idea of identifying vacant homes based on online listings.

Putting a number such as this on unused homes — and their associated emissions — is important because “real estate is a resource and has a great potential to contribute to our decarbonization goals,” says Wu.

He recommends several measures to encourage the use of empty homes. These include lowering local governments’ reliance on land-sale revenues and financial incentives that encourage homeowners with empty units to move their properties onto the resale or rental market.

“If we utilize some of this unused housing and avoid further expansion, it will contribute greatly to China’s carbon neutralization goal,” says Wu.

Reference

1. Zheng, H. et al. Nat. Commun. 16, 1985 (2025). Doi: 10.1038/s41467-025-57217-7

Editor: Guo Lili