The Master of Finance Program of the Tsinghua School of Economics and Management held a workshop on “Ethical Decision-making”for its students on May 11, inviting two finance experts from the CFA Institute, a leading global not-for-profit professional organization that provides investment professionals with finance education.

Iris Wu, Director of Institutional Relations in China at the CFA Institute and Dr. Michael G McMillan, Director of Ethics Education and Professional Standards at the CFA Institute, delivered remote lectures to the students on Ethics and Standards in CFA (Chartered Financial Analyst) Program exams. The CFA Program curriculum prepares candidates to be effective and ethical investment professionals.

The guest speakers explained ethics through case demonstrations to the students.

Dr. McMillan placed students into real-life ethical dilemmas that investment professionals face, asking them to anonymously vote on what is ethically correct to do for the case, and explained and reflected on what investment professionals would do as a result.

Dr. McMillan first outlined the primary responsibilities and obligations of investment professionals and the importance of ethics when working in the financial industry. First, investment professionals must be adept communicators of knowledge and information to their clients, for example, explain how financial markets operate in a clear and understandable manner to clients. Second, their job is to cause positive change in clients’ lives, by helping guide and instruct clients to achieve their financial goals. Third, investment professionals must exercise special skills developed from education and training in the best interest of their clients.

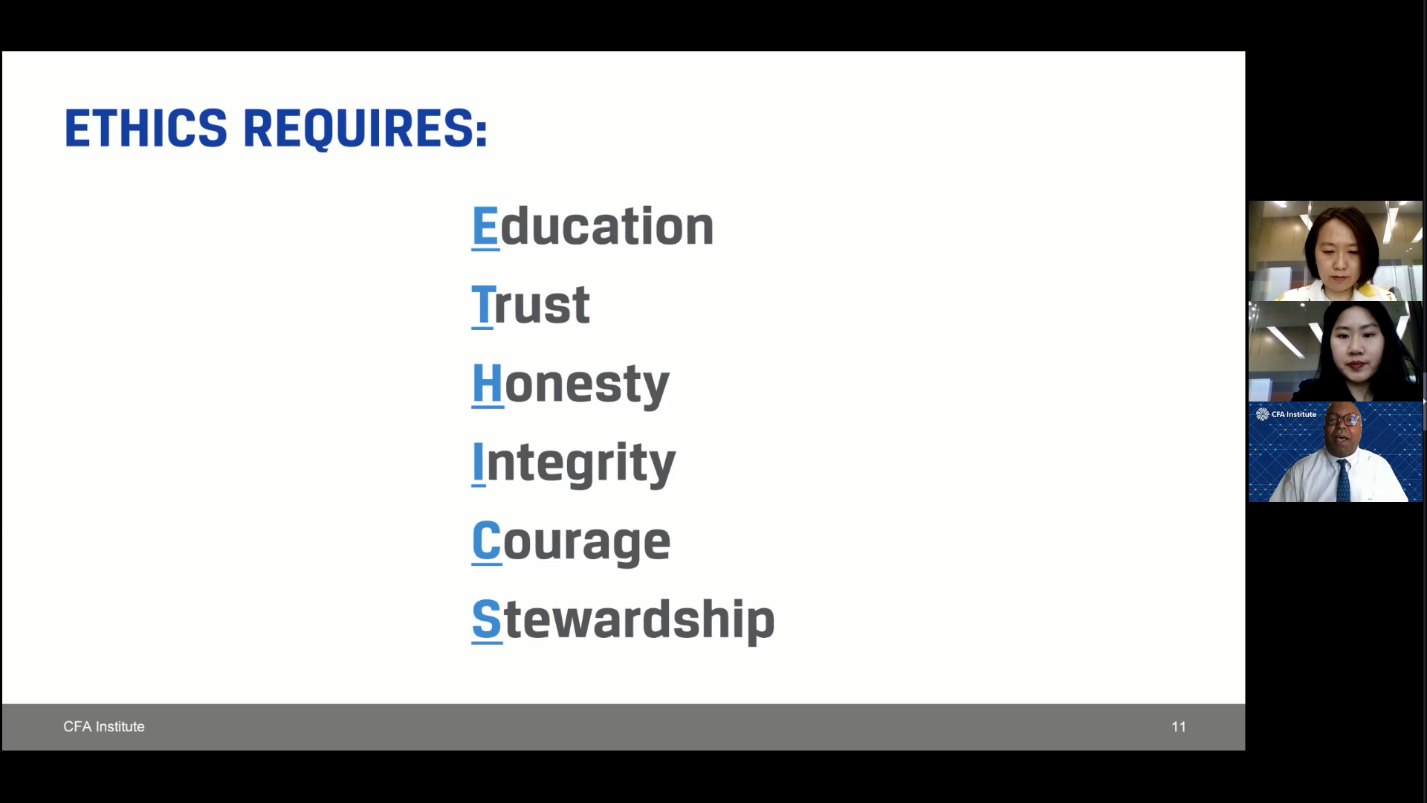

Dr. McMillan defined“Ethics”in six parts:

(E)ducation

(T)rust

(H)onesty

(I)ntegrity

(C)ourage

(S)tewardship

Ethics begins with education, not just understanding finance, but also understanding the law, rules, regulations in the country or jurisdiction in which you are doing business. Ethics then requires trust, and trust is earned, not given, so in order to gain the trust of clients, one must be honest, have integrity, courage, and also be a steward to the client’s money. Integrity means modeling the values of the organization you are working for, by being transparent, consistent, honest, moral, and trustworthy, as well as acting with authenticity, speaking the truth and taking responsibility for your actions. Courage means not shrinking from threats, challenges, and difficulties, and speaking up what is ethically right, and acting with conviction. Stewardship means being careful and responsible with the management of money that is entrusted to one’s care.

The goal of the ethics workshop was to encourage the students to become more conscious and aware of their thoughts and behaviors so they would be more likely to notice and act upon ethical issues in the investment industry.

People often make unethical decisions not because we are “bad people” but because we are often affected by psychological biases, social and organizational factors, and situational influences. These factors will lead to weaknesses in how we process information and make decisions which can lead to unethical behaviors, according to Dr. McMillan.

He emphasized the importance of truly understanding ethics and honesty not only because the ethics topic takes up 10-15% of each level of the CFA exam but also because “honesty is the only policy in any career.” This is because a career is a long-term choice, compared to a job that is short-term. To last long term and have a career in any industry, especially financial and investment banking, one needs to gain the trust of clients to last in the industry.

Introduction of Speakers:

Iris Wu, CFA

Iris Wu, Director, Institutional Relations, China of CFA Institute, has more than 20 years in the financial industry. She is responsible for building strategic partnerships across China with key financial institutions, regulators, associations and universities.

Prior to CFA Institute, she had a ten-year career at Thompson Reuters in Beijing. Before moved back to Beijing, Iris worked in Toronto as a financial analyst in the global equities team at CIBC, and consultant for the York Consulting Group.

Along with her CFA Charter, Iris holds a Bachelor of Science degree from Peking University in Beijing and an MBA from the Schulich School of Business at York University in Toronto.

Dr. Michael G. McMillan, CFA, CPA, CCEP

Director, Ethics Education and Professional Standards, CFA Institute

Dr. McMillan joined CFA Institute in October of 2008 after more than a decade as a professor of accounting and finance at Johns Hopkins University’s Carey School of Business and George Washington University’s School of Business. Prior to pursuing a career in academia, he was a securities analyst and portfolio manager at Bailard, Biehl, and Kaiser and Merus Capital Management in San Francisco, California.

Dr. McMillan has a PhD in accounting and finance from George Washington University, an MBA from Stanford University, and BA from the University of Pennsylvania. He is a Chartered Financial Analyst (CFA), a Certified Compliance and Ethics Professional (CCEP), a Chartered Investment Counselor (CIC), and a Certified Public Accountant (CPA).

Source: School of Economics and Management

Editors: Guo Lili, Sangeet Sangroula