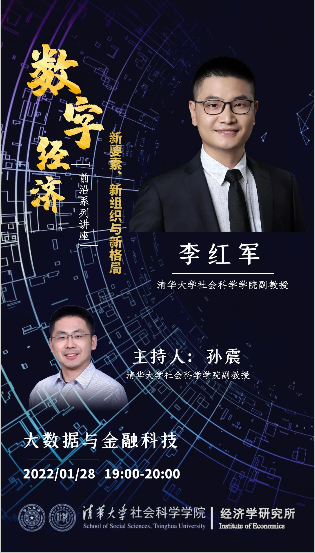

On January 28, Li Hongjun, associate professor at the Institute of Economics, School of Social Sciences, Tsinghua University, gave the Lecture 8 of Frontiers of Digital Economy Lecture Series on big data and financial technology, which was hosted by Sun Zhen, associate professor at the Institute of Economics, School of Social Sciences, Tsinghua University.

Prof. Sun introduced Prof. Li’s academic background and academic achievements, and the main content of this lecture. He remarked that the previous two lectures have initially explored the role of the digital economy in economic growth and income distribution. In this lecture, Prof. Li will indirectly reveal the fundamental significance of big data for the digital economy by discussing how big data affects financial technology, and introduce the relevant knowledge and practical application of big data and financial technology.

Prof. Li noted that the core of this lecture is to annotate and supplement the previous seven lectures by using specific examples of big data in finance to reflect the underlying logic of the digital economy. His first example is of the optimal portfolio problem, pointing out that the Markowitz mean-variance portfolio theory of optimal portfolios exhibits an unsatisfying performance and suffers dimensional problems. This suggests that the challenges of high-dimensional data (big data) analysis existed before the concept of big data was emphasized.

Prof. Li interpreted the key points of academician Mei Hong and the State Council’s Outline of National Action for Facilitating Big Data Industry Development, and introduced the broad and narrow concepts of big data. The big data in a narrow sense mainly refers to the collection of big data, while in a broad sense, includes the analysis technology of big data and the corresponding industry of big data application. He pointed out that there are various definitions of big data which generally contain the three features of “volume”, “variety”, “velocity”, and IBM has also added the facture of “veracity” in summarizing big data. Prof. Li believed that big data is a collection of large complex datasets that cannot be analyzed using traditional computing techniques; and the data processing is broadly divided into several steps, such as data collection, storage of data, processing of data, data analysis, data use and data visualization.

Then Prof. Li introduced the concepts of financial technology and big data in finance. He indicated that financial technology is the combination of big data, artificial intelligence, blockchain, cloud computing and other cutting-edge technologies with traditional financial services and scenarios such as payment and settlement, lending and financing, while the essence of big data in finance is the processing of financial big data. Similar to big data in the general sense, financial big data also has the characteristics of large scale, high dimensionality and complex structure. Its processing is also divided into four steps: data collection, storage of data, processing of data and data analysis and data visualization. It should be noted that financial big data is not limited to financial-related data, and many other behavioral data related to individuals can be included in its scope.

Next, bases on the literature, Prof. Li analyzed in detail three examples of high-dimensional portfolio, Alpha-test and credit scoring from the aspects of mathematical principles, practical application and data results, and conducted exploration and discussion. He remarked that big data is widely used and plays an important role in text analysis, financial regulation, data security, and industrial ecology and other aspects. Big data is the foundation of the digital economy. Financial technology is the innovative application of technology in the financial sector, and the Chinese government has attached great importance to its development. With the core of financial big data, big data in finance has been largely explored in the academia and industry. In addition, he introduced the Journal of Digital Economy, a new journal founded by the Institute of Economics, School of Social Sciences, Tsinghua University, and Master’s program in digital economy of Tsinghua University under planning.

At the end of the lecture, Prof. Sun reviewed the entire series of lectures on the digital economy. He said that the Lecture Series focuses on the new economic form of digital economy, and gives a detailed introduction from three aspects of new elements, new organization and new pattern. In the lectures 1-3, Prof. Cai Jiming, Prof. Rong Ke and Prof. Tang Ke introduced the new element “data elements”, “the value basis of distribution based on contributions of data elements”, “data ownership and hierarchical data classification management” and “transaction and markets”, respectively. In the lectures 4-5, Prof. Wang Yong and Prof. Sun Zhen respectively introduced the “development history, development characteristics and challenges” of the “new organization” of the platform, and “platform operator concentration and anti-monopoly regulation”. In the lectures 6-8, Prof. Xie Danxia, Prof. Liu Taoxiong and Prof. Li Hongjun respectively introduced in detail how the digital economy affects economic growth, income distribution and modern finance, focusing on the “new pattern” of the digital economy participating in economic development. Prof. Sun expected that the Lecture Series will give us a basic understanding of the development of the digital economy, of the opportunities and challenges it brings. The digital economy is expected to continue growing and bring new problems in the future. This Lecture Series is just the beginning, and we look forward to exploring the digital economy with you on different occasions in the future.

This Lecture Series is supported by Sina Finance, NetEase Finance, Chinese Headlines, Xueshuo and KeAi’s Journal of Digital Economy.