--a lecture given by Pierre van der Eng at the Chen Daisun Lecture of Theoretical Economists, Tsinghua University

At 12:00 on June 11, 2019, Pierre van der Eng, Associate Professor of Australian National University & Visiting Professor of Tsinghua University, gave a lecture titled “Real Effective Exchange Rate (REER) Volatility and Long-term Economic Growth of Indonesia” at “the Chen Daisun Lecture of Theoretical Economists” and “Tsinghua Economic History Lecture”. The lecture was chaired by Long Denggao, Director of Center for Chinese Entrepreneur Studies and Professor of Institute of Economics, School of Social Sciences, Tsinghua University.

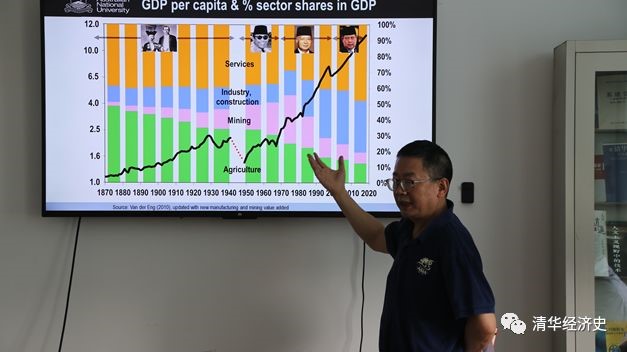

Pierre van der Eng gives the lecture

Based on the research by Reinhart, Rogoff and Rodrik, Prof. Pierre van der Eng put forward independent insights on the relationship between exchange rates and economic growth to explain the long-term economic history of Indonesia. First of all, he macroscopically analyzed the changes in per capita GDP and in proportions of the three industries in each stage since Indonesia became an independent nation from a Dutch colony. He described the causes of long-term economic fluctuations in Indonesia. First, with a low population density, Indonesia has long been depending on primary exports rather than manufacturing. Second, Indonesia has pursued the trade-restraining development mode for a long time, which facilitates the formation of non-commodity trade and affects the manufacturing industry, especially textile. Additionally, he explained that the research on REER vitality and long-term economic growth usually employed multi-country datasets while this one-country case study could avoid the differences in resource endowment and the nuances of exchange rate systems among different countries. Indonesia has long been an exporter of primary products and since 1870, the country has gradually shifted its main exports from agricultural products to mineral products (including oil) and then to manufactured goods, indicating a gradual decline in the share of agricultural exports and the development of manufacturing. Since the national independence of Indonesia, especially after 1985, the share of manufacturing in exports has increased gradually, and the rise in oil trade brought about an export boom.

Scene of the Lecture

What is the relationship between REER and long-term economic growth? Prof. Pierre suggests that three stages with different characteristics can be observed from the changes in Indonesian exchange rate system since 1870:

1)During 1877-1940, Indonesia implemented the guilder-linked gold exchange standard system and general nominal exchange rates. But the long-term instability of REERs impeded non-commodity manufacturing in trade.

2)During 1940-1978, Indonesia implemented strict foreign exchange control to restrict capital flows, which, together with multiple exchange rates for import & export taxation, opaque export incentives and import surcharges during 1950-1970, triggered constant growth of the parallel market (black market) during the 1950s and 1960s and consequent economic collapses.

3)During 1978-2018, Indonesia pegged its currency to the US dollar and implemented a combination of stable exchange rate system and managed floating rate system, and has pursued freely floating exchange rates since 2013.

REER has an impact on Indonesia’s economic development and floating exchange rates are a buffer against major price adjustments at home. Prosperity means appreciation, attracting resources such as labor and capital into thriving industries and posing upward pressure on domestic factors and commodity prices; while decay means depreciation. He believes that the effective exchange rate system is good for economy, especially in resisting economic shocks. With regard to the economic downturn in Indonesia following the financial crisis in 1998, Prof. Pierre indicates it is mainly caused by the externalities of China’s economic development.

In his nearly two-hour lecture, Prof. Pierre discussed the changes in trade terms and REERs facing Indonesia through a case study of the country. He analyzed the relationship between different exchange rate systems and long-term economic growth, with the aim of probing into the nuances of exchange rate systems and the economic context that affects economic growth.

Prof. Long Denggao makes comments

Discussions and interactions were active in the lecture, and Prof. Pierre gave detailed answers to questions raised by teachers and students present on the service industry, trade with other Southeast Asian countries, transportation and religion factors, oil economy and gold standard system in Indonesia.

(Written by Zhang Jiao; photographed by Wang Ming; edited by Qu Na)